Monetary Durability: Building a Solid Structure to Avoid Insolvency

In today’s unforeseeable financial environment, building monetary durability is crucial for people and companies alike. By developing a strong monetary structure and adopting positive strategies, you can reduce the risk of insolvency and browse through monetary challenges with self-confidence. Here are some key actions to reinforce your monetary durability and avoid insolvency:

1. Develop an Emergency situation Money

An emergency situation money acts as a monetary safeguard throughout unexpected circumstances such as job loss, clinical emergency situations, or unexpected costs. Aim to conserve at the very least 3 to 6 months’ well worth of living costs in a different savings account. desmoinesbankruptcy.com can provide assistance on how to begin and expand your emergency situation money, ensuring you have the necessary funds to weather any monetary tornado.

2. Decrease Financial obligation and Manage Costs

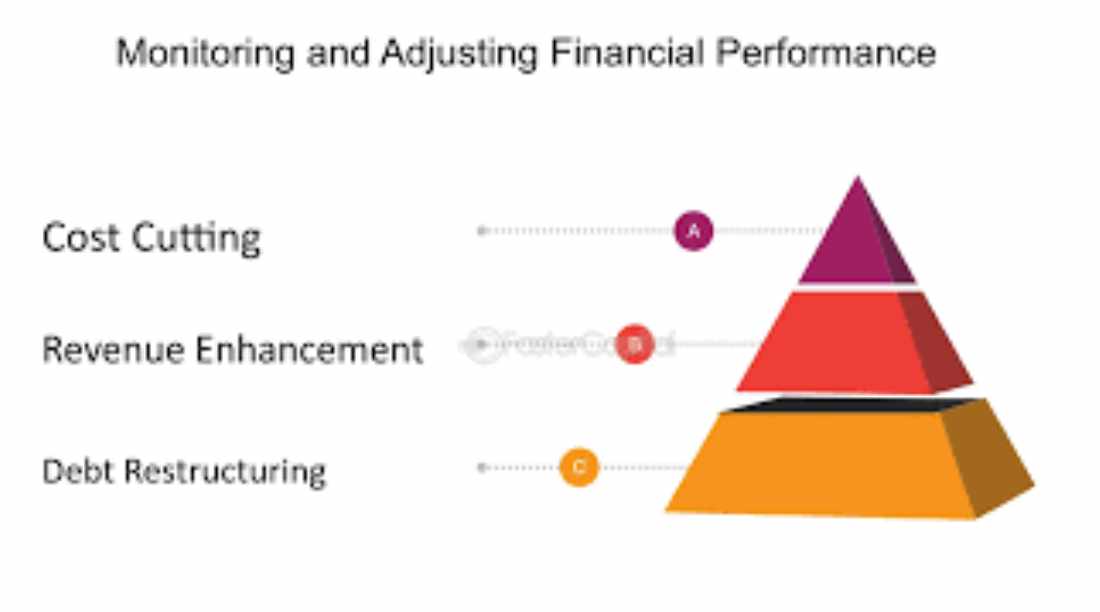

Excessive financial obligation can quickly spiral uncontrollable and lead to monetary distress. Focus on paying off high-interest financial obligations while also maintaining a shut eye on your costs. Consider producing a budget plan to track your spending and determine locations where you can cut down. DesMoinesBankruptcy offers tips and sources to assist you develop a financial obligation repayment plan and manage your costs effectively.

3. Expand Earnings Resources

Relying entirely on one resource of earnings can leave you vulnerable to monetary instability. Explore opportunities to expand your earnings by purchasing supplies, realty, or beginning a side business. DesMoinesBankruptcy can provide understandings right into various income-generating opportunities and help you produce a varied earnings profile to protect versus unexpected earnings loss.

4. Spend in Insurance Coverage

Insurance provides monetary protection versus unexpected occasions such as disease, impairment, or property damage. Make certain you have adequate insurance coverage, consisting of health and wellness insurance, life insurance policy, impairment insurance, and property insurance. DesMoinesBankruptcy can assist you in understanding various insurance options and choosing the right coverage for your needs.

5. Educate On your own About Monetary Management

Monetary proficiency is an effective device for building durability and avoiding insolvency. Make the effort to educate on your own about individual finance subjects such as budgeting, spending, and financial obligation management. DesMoinesBankruptcy offers academic sources, articles, and workshops to assist you improve your monetary proficiency and make informed choices about your financial resources.

By implementing these strategies and leveraging the sources available through DesMoinesBankruptcy, you can develop a solid monetary structure and avoid the pitfalls of insolvency. Keep in mind that monetary durability is a trip, and it requires diligence, self-control, and ongoing initiative. With the right devices and assistance, you can browse through monetary challenges and arise more powerful and more durable compared to ever before.